When Water Meets Lithium

Can batteries support Run-of-River power plants during periods of low electricity prices? - by Yannick Schüpbach

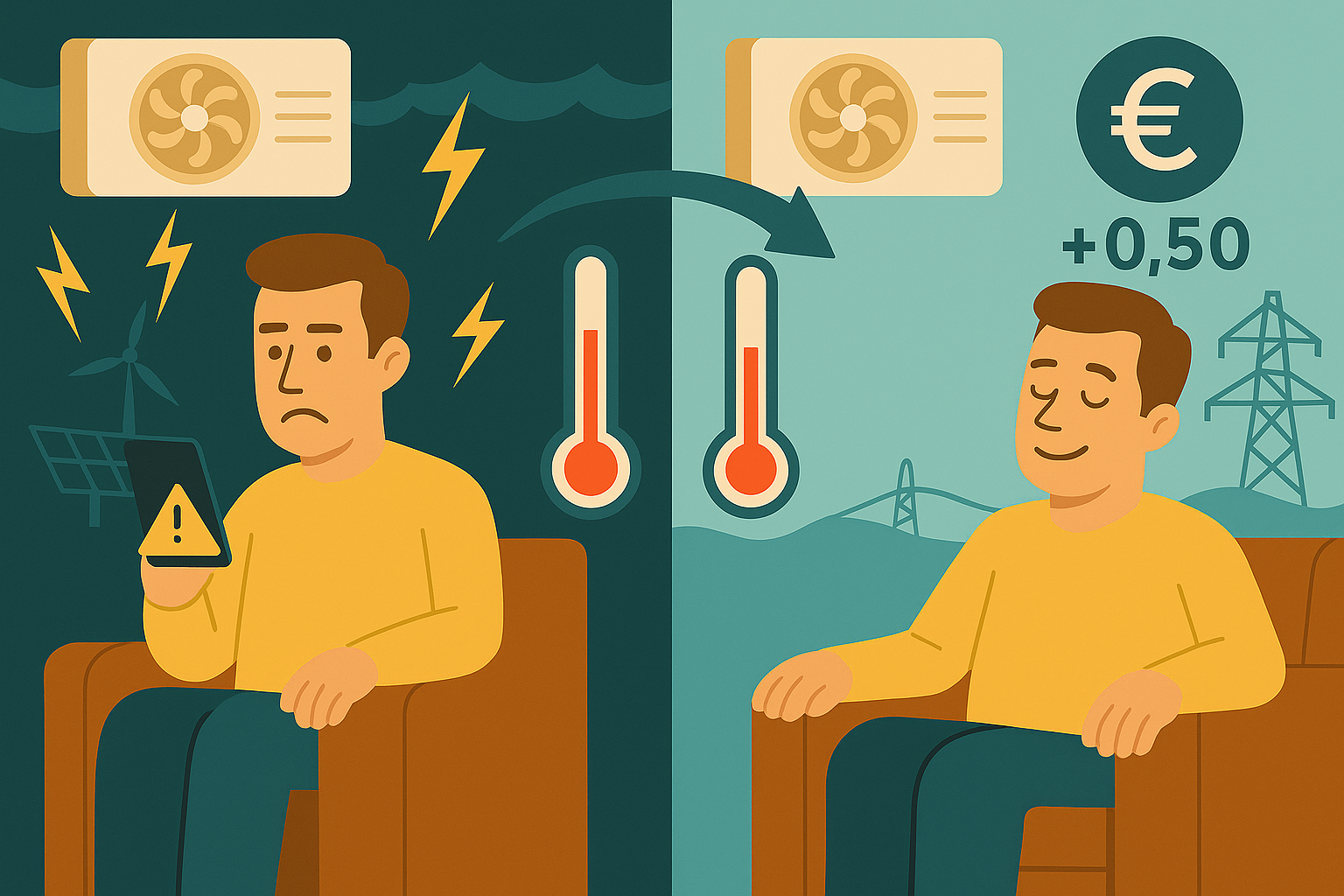

Electricity prices, like those of any other commodity, are determined by demand and supply. When electricity supply overwhelms demand, the prices can plummet, and sometimes even become negative. Picture a sunny Sunday afternoon: Generation from photovoltaics floods the energy grid with power, households and businesses consume less electricity, and residential energy use is reduced as people spend more time outdoors. As a result, electricity prices drop.

While low electricity prices might sound appealing to consumers, they can be a nightmare for electricity producers that operate Run-of-River (RoR) power plants. These plants generate electricity by channeling flowing river water through turbines.

Because RoR power plants operate within delicate river ecosystems, they are required to follow strict environmental guidelines; most notably, they need to maintain stable water levels. This constraint means the turbines are forced to produce power regardless of market conditions, effectively selling at a loss when electricity prices drop to zero or become negative. If you were an RoR energy producer, how would you deal with this problem?

One potential solution is to add energy storage, such as a lithium-ion battery, to the system. With energy storage in place, operators can store excess electricity during times of low prices and sell it later at higher market prices. From a financial standpoint, installing energy storage makes sense if the additional profits earned by storing and selling electricity at favorable prices outweigh the energy storage’s investment and operation costs over the same time horizon.

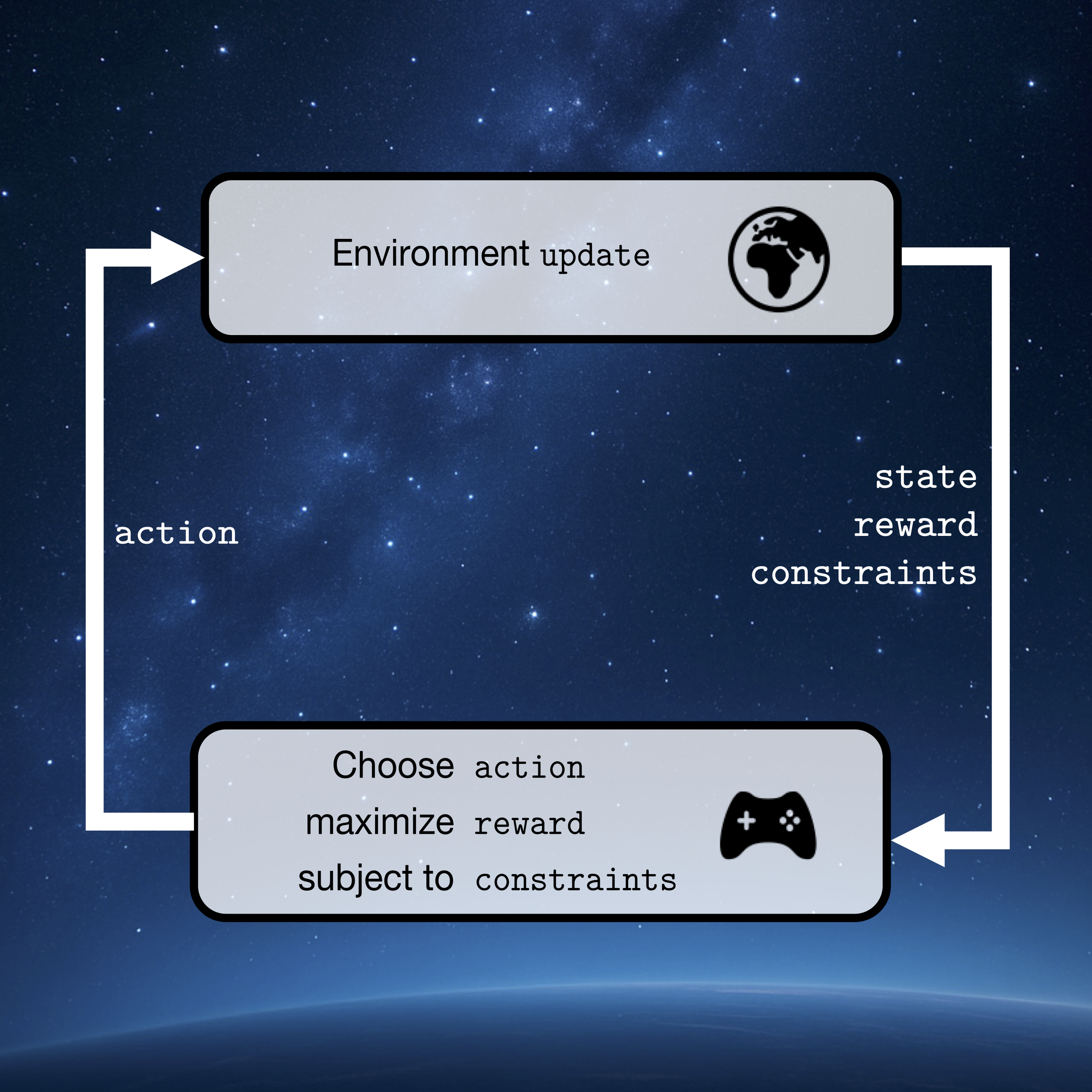

In collaboration with the Elektrizitätswerk der Stadt Zürich (EWZ), we explore exactly this idea: We evaluate whether installing a battery can help RoR plants reduce their financial losses during periods of low electricity prices. We estimate the potential profits from energy storage by formulating and solving an optimization problem that models the RoR plant, the battery, and their interaction with different Swiss energy markets. The main challenge of the project is to make the right assumptions and simplifications, so we can find an optimal solution to the problem, while ensuring the results accurately reflect real-world conditions. Finding the right trade-off between accuracy and complexity is key to tackling the feasibility assessment and offering meaningful insights into the interplay of water and lithium-ion batteries.

Text by Yannick Schüpbach; illustration generated with ChatGPT Mitigating the detrimental effect of AI on the power grid - by Jethusan Jeyaruban

How to increase the transmission capacity of the electric power grid efficiently and economically - by Samuel Renggli

Can batteries support Run-of-River power plants during periods of low electricity prices? - by Yannick Schüpbach

Using real-time sensors to detect early warning signs of power grid instability - by Ioannis Papadopoulos

Learning taxi prices through interactions - by Zhiyu He